In recent years, the fintech industry has experienced explosive growth, with new companies emerging that challenge traditional financial models and offer innovative solutions. As we move through 2024, several fintech startups and established companies are leading the charge, transforming the financial landscape in ways that were once considered futuristic.

This article will introduce you to eight fintech companies and startups that are making significant impacts this year. From groundbreaking technologies to disruptive business models, these companies are worth keeping an eye on.

Emerging Fintech Leaders to Watch in 2024

As we delve into the world of fintech for 2024, it's clear that the industry is not just growing but evolving at a rapid pace. This year, several companies and startups have emerged as key players, each bringing innovative solutions that challenge traditional financial systems and offer new possibilities for managing and investing money.

From advancements in digital banking to cutting-edge payment technologies, these fintech leaders are setting new standards and reshaping the future of finance. Lets explore how these standout companies are making their mark and what sets them apart in a dynamic and competitive landscape.

Stripe

Stripe will continue to be a dominant force in the fintech space in 2024. Known for its easy-to-integrate payment processing solutions, Stripe has expanded its services beyond payments to include financial management and fraud prevention.

The company has recently introduced advanced tools that enable businesses to manage their finances more seamlessly, making it an indispensable tool for startups and established companies alike. Stripe's latest innovations focus on improving payment efficiency and enhancing security, making it a top choice for businesses looking to streamline their financial operations.

Revolut

Revolut has solidified its position as a leading digital banking platform with its comprehensive suite of financial services. In 2024, It has continued to evolve, offering new features that cater to a global audience. Revolut provides a one-stop shop for users looking to manage their finances. Its user-friendly app and competitive pricing make it an attractive option for those seeking a modern approach to banking.

Plaid

Plaid remains a crucial player in the fintech ecosystem by providing the infrastructure that connects applications with users bank accounts. In 2024, Plaid has expanded its capabilities to offer more robust data aggregation and analytics tools. These enhancements allow financial institutions and fintech apps to offer better services, from improved financial planning tools to more accurate credit scoring. Plaids technology underpins many of the new fintech solutions emerging this year, making it a cornerstone of the industry.

Chime

Chime continues to make waves in 2024 as a leading neobank that is redefining the banking experience with its customer-centric approach. Unlike traditional banks that often come with a plethora of fees, Chime focuses on providing a no-fee banking experience, which includes no overdraft fees, no monthly maintenance fees, and no foreign transaction fees.

This year, Chime has further enhanced its offerings with features such as automated savings tools that help users effortlessly set aside money, and early direct deposit options that allow customers to access their paycheck up to two days earlier. By prioritizing transparency and accessibility, Chime not only simplifies banking but also helps users manage their finances more effectively, making it a standout choice for those looking for modern, hassle-free financial services.

SoFi

SoFi has made a name for itself by offering a wide range of financial products, from personal loans to investment management. In 2024, SoFi has expanded its offerings to include new wealth management services and educational resources. The companys focus on providing comprehensive financial solutions and its commitment to user education position it as a valuable resource for individuals looking to take control of their financial futures.

N26

N26, a prominent European challenger bank, has continued to make waves in 2024 with its streamlined mobile banking services. The bank offers a suite of features designed to simplify its users' financial lives, including no foreign transaction fees, real-time spending notifications, and intuitive budgeting tools.

This year, N26 has expanded its services to include innovative features such as automated savings plans and enhanced financial insights, catering to a tech-savvy audience. By focusing on user experience and financial transparency, N26 distinguishes itself as a forward-thinking alternative to traditional banking, making it a popular choice for both new and experienced banking customers across Europe and beyond.

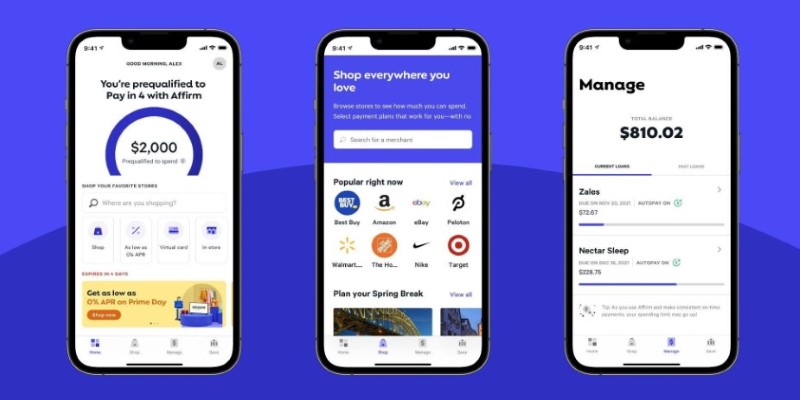

Affirm

Affirm is revolutionizing the way consumers approach financing with its buy now, pay later (BNPL) solutions. In 2024, Affirm has expanded its partnerships and product offerings to provide more flexible payment options. The companys BNPL services allow consumers to make purchases and pay for them over time, often with no hidden fees. Affirms approach to consumer finance aligns with the growing trend of flexible payment solutions and positions it as a key player in the fintech space.

Robinhood

Robinhood has solidified its reputation as a major disruptor in the investment space with its commitment to democratizing finance. In 2024, the company continues to make waves with its commission-free trading platform, which has expanded to include advanced analytics tools and educational resources.

These new features are designed to enhance the trading experience, providing both novice and seasoned investors with the insights they need to make informed decisions. Robinhoods user-centric approach and dedication to accessibility ensure that it remains a prominent player, making investing more approachable and transparent for everyone.

Conclusion

The fintech landscape in 2024 is rich with innovation and disruption, driven by companies that are redefining how we manage and interact with our finances. From payment processing giants like Stripe to digital banking pioneers like Revolut and N26, these fintech companies are at the forefront of a financial revolution.

Each of these startups and established firms brings something unique to the table, offering new solutions that cater to the evolving needs of consumers and businesses alike. As the fintech industry continues to evolve, keeping an eye on these key players will provide valuable insights into the future of finance.